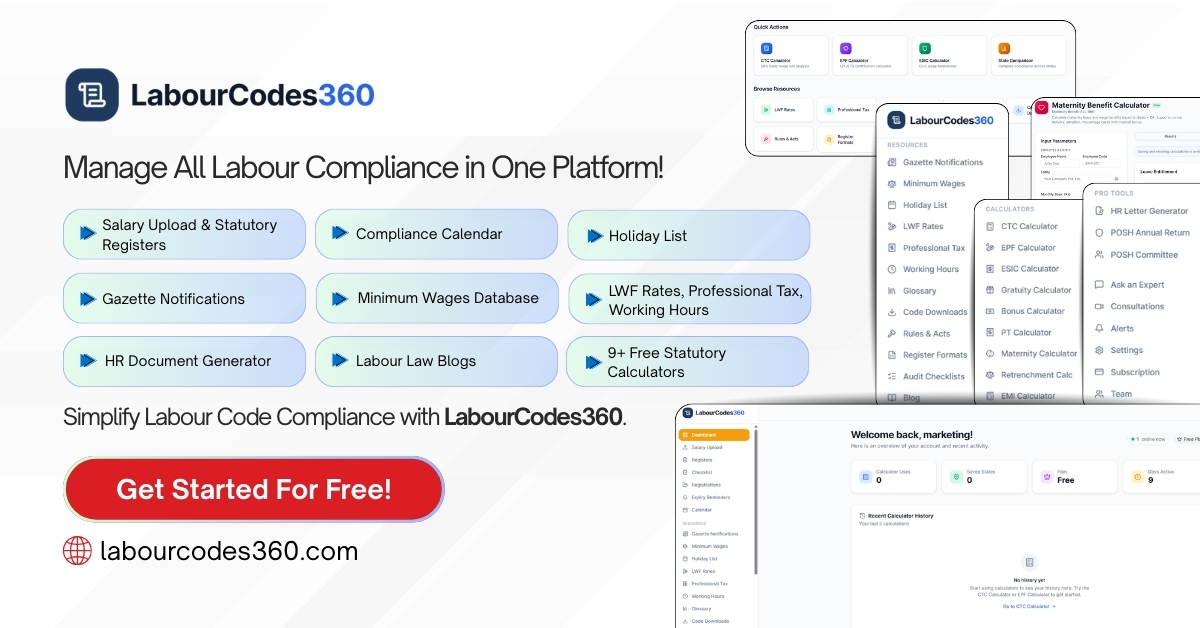

Empowering businesses with smarter HR & Payroll management!

The easy accessibility to the Payroll and employees database makes it a boon for every company. This web-hosted payroll software offers convenience that has no match since the complicated task which required hours can now be done in a blink of an eye.

The Sheer Convenience Is The Reason Why 5000+ Users Rely On HRMTHREAD For Payroll And HRM Solutions.

The easy accessibility to the Payroll and employees database makes it a boon for every company. This web-hosted payroll software offers convenience that has no match since the complicated task which required hours can now be done in a blink of an eye.

Mobile App

Mobile App is optimized to provide quick & easy access.

Employee Database

Get the entire information about the employee in one go.

Payroll

Have a complete command over the payroll.

Time & Attendance

The most comprehensive time-tracking Software.

Leave Management

Manage all your leaves under one umbrella

Claim & Reimbursement

Track your Claim & Reimbursement hassle-free.

Loans & Advance

Get Instant Information about all your loans & advances

TDS & Tax Planner

Salary TDS calculations simplified.

Exit Management

It have the information needed to manage employee exits effectively.

Travel Management

Time-efficient travel expense handling

Employee Self Service

A dynamic Employee Self Service Management

Time Sheet

Control labor costs & working hours of employees

Recruitment

Recruiting has never been this easy

Performance (PMS)

Boost your employee’s performance with 360-degree appraisal.

Training

Equip your employees with skills that drive business success.

Initiation by Boarding Authority

Stay compliant with all labor laws and tax regulations — HRMThread takes care of it all, from start to finish, with zero manual errors.

What’s Covered:

- PF, ESI, PT, TDS calculations and automated filings

- Auto-generation of challans, Form 16, salary structures & IT reports

- Seamless integration with government portals for easy submissions

- Real-time compliance updates based on latest statutory changes

- Easy audit trails and downloadable compliance reports

Whether you’re a growing business or managing a large workforce, HRMThread ensures your payroll stays 100% compliant — always.

Employee Self-Service Portal

Empower your employees with full control and transparency — all essential HR and payroll details are available 24/7, from desktop or mobile.

Geo Fencing Capabilities

Secure your attendance tracking with precise location verification. Punch-ins & Punch-outs are enabled only within employer-defined virtual boundaries, leveraging GPS technology for accuracy & integrity.

Secure Payroll Processing

Protect employee data with bank-grade security and strict access controls. HRMThread ensures your most sensitive information stays safe — always.

Scalable for Every Business

Whether you’re a fast-growing startup or a large enterprise, HRMThread scales effortlessly to match your payroll needs today and as you grow.

360° Payroll Management

Run payroll in just a few clicks — accurately, on time, and stress-free.

HRM Thread automates every step so you can focus on what matters.

What You Can Do:

- Pay full-time, part-time, interns, and freelancers — all in one system

- Settle reimbursements instantly or along with monthly salaries

- Easily manage both regular and off-cycle payroll runs

- Auto-generate payslips, salary slips, and bank transfer statements

Whether it’s a five-person team or a multi-location workforce,

HRMThread ensures smooth, compliant payroll every single month.

Start to finish Payroll Outsourcing Services

Our online HR software package offers more than streamlined payroll services. In addition, you will receive access to all features of our HRIS software, including time

MIS Reports

Final Settlement

Form 16

Explore More

Payslip on WhatsApp

Still receiving payslips in envelopes or through traditional mail? It’s time to move forward! With HRMThread, employees can now get their payslip directly on WhatsApp — anytime, anywhere.

Instant access

Paperless & eco-friendly

Simplified payroll process

Explore More

Seamless Employee Onboarding with HRMThread

A smarter, faster, and compliant way to welcome new hires.

Initiation by Boarding Authority

Data Security and Compliance

Workflow and Verification

Explore More

Provided Certain Resources

Get Started With a New Way of Working Today

Happy clients, happier us!

Trusted solutions, satisfied clients.

Awards & Recognitions

Stay Informed With The Latest Trends

How Does Leave Management Software Reduce HR Administrative Burden?

Leave management software helps in eliminating the paperwork as it manages the leave requests, leave approvals, and tracking, simply saving a lot of HR time and eliminating errors. This software will enable those that wish to go on leave to apply for it, and the...

Provision of Simplified Process for Provident Fund Account Transfers.

The Employees Provident Fund Organization has streamlined the transfer process of Provident Fund Accounts for members changing employment. This new guideline eliminates the requirement for routing through previous employers in specific cases, ensuring a smoother...

Why Payroll Software Is a Must-Have for Remote and Hybrid Teams?

Payroll software is essential for remote and hybrid teams, streamlining payroll processes while ensuring accuracy and compliance across diverse locations. Employees working in different locations across different time zones and often under different labor laws require...

How Does Payroll Software Help with Employee Benefits Management?

Tax & Compliance Due Date Calendar for December 2024.

Why Is Attendance Software Essential for Modern Businesses?

Attendance software is used to carry out efficient operations in businesses today since the product can effectively manage the records of employees’ working hours and attendance, reduce manual paperwork, and ensure that Payroll features such as Auto data collection,...

How Secure Is Your Data with Payroll Software Solutions?

Data security is a top priority when using payroll software solutions, especially in a market like that of payroll software in India. Current payroll systems are secure to ensure users enter the right credentials to access the system and to avoid outside intruders...

Tax & Compliance Due Date Calendar for December 2024.

07th TDS Payment for November 2024. 10th GST Return for authorities deducting tax at source - GSTR 7 for November 2024. Details of supplies effected through the e-commerce operator and the amount of tax collected-GSTR 8 for November 2024. 11th GST Details of...

Important Update: UAN Activation Guidelines and Timeline.

As per the attached circular, we would like to inform you about recent updates and guidelines regarding UAN (Universal Account Number) activation for employees. The circular highlights the following key points: 🔹 Objective To streamline the process of UAN activation...

How Does Payroll Software Help with Employee Benefits Management?

Payroll software in India simplifies employee benefits management by automating benefit calculations and ensuring accurate distribution. With the software, organizations can easily manage a range of benefits like health insurance, provident funds, and tax-saving...