West Bengal Minimum Wages Revised from 1st January 2026

The Government of West Bengal, vide Notification No. 07/Stat/14/RW/24/2023/LCS/JLC dated 09.01.2026, has officially...

How Can HR And Payroll Software Support Business Growth In Lucknow?

Lucknow is gradually becoming a promising business location with an increasing number of activities taking place in...

Why is Payroll Compliance Automation Important For Noida Employers?

Noida has become a significant business and technology hub, which hosts IT business, manufacturing industries,...

Why Is Real Time Attendance Monitoring Important for UAE Employers?

Why Is Real Time Attendance Monitoring Important for UAE Employers? In the UAE, time management is closely tied to...

How Does HR Software Help Manage Multi Nationality Workforces in Dubai?

The workforce in Dubai is not like that of practically anywhere in the world. Enter any office and you will most...

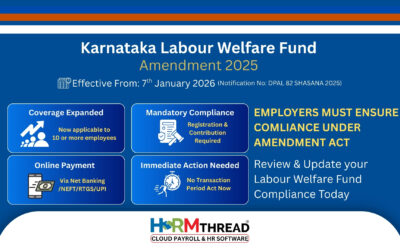

Karnataka Labour Welfare Fund (Amendment) Act, 2025

The Karnataka Labour Welfare Fund (Amendment) Act, 2025 has come into force with effect from 7 January 2026, pursuant...

Rajasthan Shops & Commercial Establishments (Amendment) Ordinance, 2025

The Government of Rajasthan has issued the Rajasthan Shops and Commercial Establishments (Amendment) Ordinance, 2025,...

Nidhi Aapke Nikat 2.0 – EPFO Camp Venue Details for 29 December 2025 | Year-End Grievance Redressal Drive

As the year 2025 comes to a close, the Employees’ Provident Fund Organisation (EPFO) is organizing a special year-end...

Why Do Companies Prefer Integrated Attendance and Payroll Software?

When organizations expand, there is a tendency to have a separate system to handle employee attendance and payroll,...

How Can Leave Management Software Reduce Payroll Errors and Compliance Risks for Growing Companies

When the business is growing, HR teams usually face the difficulty of keeping accurate records of attendance and leave...