The Government of Maharashtra has revised the minimum wages effective from 1 July 2026 to 31 December 2026 through the...

Government Update

Select TDS Rate Chart: Assessment Year: 2026-2027 Financial Year: 2025-2026.

Presenting the new TDS Rate Chart for AY 2026–27, FY 2025–26! This TDS Rate Chart will help you understand the...

West Bengal Minimum Wages Revised from 1st January 2026

The Government of West Bengal, vide Notification No. 07/Stat/14/RW/24/2023/LCS/JLC dated 09.01.2026, has officially...

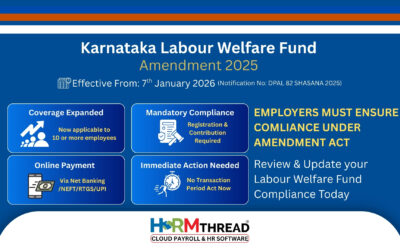

Karnataka Labour Welfare Fund (Amendment) Act, 2025

The Karnataka Labour Welfare Fund (Amendment) Act, 2025 has come into force with effect from 7 January 2026, pursuant...

Rajasthan Shops & Commercial Establishments (Amendment) Ordinance, 2025

The Government of Rajasthan has issued the Rajasthan Shops and Commercial Establishments (Amendment) Ordinance, 2025,...

Nidhi Aapke Nikat 2.0 – EPFO Camp Venue Details for 29 December 2025 | Year-End Grievance Redressal Drive

As the year 2025 comes to a close, the Employees’ Provident Fund Organisation (EPFO) is organizing a special year-end...

Launch of Online PF-ESIC-Gratuity Compliance Calculator Aligned with the Code on Wages, 2019 & Code on Social Security, 2020

With the implementation of the Code on Wages, 2019 and the Code on Social Security, 2020, employers across India are...

Employees Enrolment Campaign 2025 (EPFO Amnesty Scheme): Big Relief for Employers from 1st November 2025

Notification: G.S.R. 749(E) dated 10th October 2025Issued By: Ministry of Labour & Employment, Government of...

ESIC Implements the Code on Social Security, 2020 – Expanded Definitions of “Dependant” and “Family” (Effective 21 November 2025)

Introduction: A Landmark Change in India’s Social Security Framework On 21 November 2025, India moved a major step...

Mandatory ESIC Registration for All Educational Institutions Under the Code on Social Security, 2020: Key Directive Issued by ESIC Ahmedabad

The implementation of the Code on Social Security, 2020 (CoSS 2020) with effect from 21 November 2025 marks a major...

EPFO Passbook Not Showing After New Portal Launch? Here’s the Complete Explanation (2025 Update)

The Employees’ Provident Fund Organisation (EPFO) has recently rolled out its revamped Unified Portal with upgraded...

Gratuity Eligibility Now After Just 1 Year of Service!

Gratuity is a payout employers offer employees as a gesture of appreciation for their dedicated service.Earlier,...

New CBDT Circular Offers Relief to Someone with an Unlinked PAN? Here’s How You Can Avoid a Penalty!

The Central Board of Direct Taxes (CBDT) has issued Circular No. 9/2025, providing a major reprieve for tax...

Key Direct Tax Amendments in the 2025 Budget: A Game Changer for AY 2025-26

The Union Budget 2025 has introduced significant direct tax amendments aimed at simplifying tax laws, reducing...

Provision of Simplified Process for Provident Fund Account Transfers.

The Employees Provident Fund Organization has streamlined the transfer process of Provident Fund Accounts for members...

Important Update: UAN Activation Guidelines and Timeline.

As per the attached circular, we would like to inform you about recent updates and guidelines regarding UAN (Universal...

Karnataka Government Allows Shops and Commercial Establishments to Operate 24×7 for Three Years: Key Guidelines.

Continuous Operations for Businesses The notification allows all shops and commercial establishments employing...

Nidhi Aapke Nikat 2.0: Camp Activities – 27 September 2024.

The Employees’ Provident Fund Organisation (EPFO) continues to innovate its outreach initiatives with Nidhi Aapke...

EPF Interest Rate: Taxable Interest on Provident Fund in 2024.

The Employees’ Provident Fund (EPF) is a vital savings scheme for salaried employees in India, providing financial...

TDS on Rent: Explore Section 194I, Applicability, Limit, Rate.

Tax Deducted at Source (TDS) is a crucial compliance mechanism under the Income Tax Act, 1961. Section 194I...